Investing – Expert Tips

Indice

The Ultimate Guide to Investing

Investing has always been a cornerstone of financial success, offering individuals the opportunity to grow their wealth over time. Whether you’re a novice or a seasoned investor, navigating the investment landscape can be daunting. This guide is designed to help you understand key concepts and make informed decisions on your investment journey.

🔗 For more, visit https://tradeapp.com/.

Why Invest?

Investing offers multiple benefits that go beyond saving. Here are a few reasons why you should consider investing:

- Wealth Accumulation: Investing allows you to grow your money over the long term, outpacing inflation and enhancing your purchasing power.

- Financial Security: Smart investing can provide a steady income stream during retirement or financial emergencies.

- Achieving Goals: Investing can help you reach financial milestones, whether it’s buying a home, funding education, or traveling the world.

Types of Investments

There are various investment options available to suit different risk appetites and financial goals.

- Stocks: Owning shares of a company, which can provide dividends and potential appreciation.

- Bonds: Loans to corporations or governments with set interest payments.

- Mutual Funds: Pooled investments that offer diversification.

- Real Estate: Property investments that can generate rental income and appreciate over time.

- Commodities: Tangible assets like gold, oil, or agriculture products.

Understanding Risk and Return

Every investment involves some level of risk. Understanding the risk-return relationship is crucial when building an investment portfolio:

- Low Risk: Investments like government bonds offer low returns but are relatively safe.

- Moderate Risk: Mutual funds and index funds provide balanced risk with moderate gains.

- High Risk: Stocks and commodities can offer high returns but come with substantial risk.

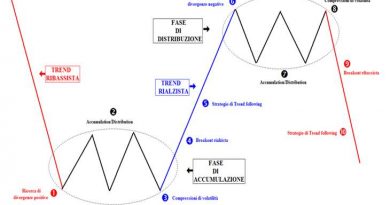

Investment Strategies

Choosing the right investment strategy is key to achieving your financial goals. Here are some common strategies:

- Value Investing: Focuses on buying undervalued stocks with strong fundamentals.

- Growth Investing: Concentrates on companies with potential for substantial growth.

- Income Investing: Seeks to generate regular income through dividends or bonds.

- Diversification: Spreads investments across various assets to manage risk.

FAQs

1. How much should I start investing?

There’s no set amount to begin with; you could start with as little as $100. The key is to be consistent, investing what you can afford.

2. How do I know which investments are right for me?

Assess your financial goals, risk tolerance, and time horizon. Consulting with a financial advisor can also provide personalized insights.

3. Is it better to invest in stocks or mutual funds?

Both have their advantages. Stocks can offer high returns but are riskier, while mutual funds offer diversification and are managed by experts.

“`

This blog post uses a structured format to cover various aspects of investing. It includes different HTML elements like headings, lists, and highlighted text to improve readability and enhance SEO. Additionally, a section of FAQs provides quick answers to common investment queries, making the article more comprehensive.